Company currently intends to commence tender offer to repurchase up to $2.0 billion of common stock.

Monster Beverage Corporation (NASDAQ:MNST) today reported financial results for the first quarter ended March 31, 2016.

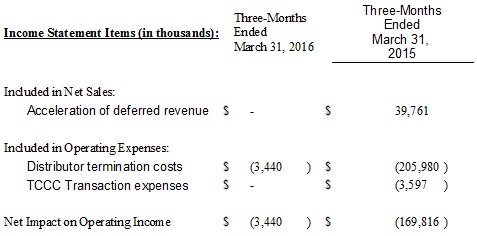

In connection with the long-term strategic partnership entered into with The Coca-Cola Company (the “TCCC Transaction”), the comparable 2015 first quarter financial results included distributor termination costs of $206.0 million, $39.8 million of acceleration of deferred revenue as a result of distributor terminations and TCCC Transaction related expenses of $3.6 million.

The following table summarizes the impact of these items on revenues and operating income for the three-months ended March 31, 2016 and 2015 (See “Reconciliation of GAAP and Non-GAAP Information” in the attached exhibit):

First Quarter Results

Gross sales for the 2016 first quarter increased 9.5 percent to $777.5 million from $710.2 million in the same period last year. Excluding acceleration of deferred revenue, gross sales increased 16.0 percent for the 2016 first quarter. Net sales for the 2016 first quarter increased 8.5 percent to $680.2 million from $626.8 million in the same period last year. Excluding acceleration of deferred revenue, net sales increased 15.9 percent for the 2016 first quarter. Unfavorable currency exchange rates had the effect of reducing gross sales by approximately $15.1 million and net sales by approximately $12.3 million in the 2016 first quarter.

Net sales for the Company’s Finished Products segment for the 2016 first quarter increased 4.8 percent to $624.3 million from $595.5 million for the same period last year. Excluding acceleration of deferred revenue, net sales for the Company’s Finished Products segment increased 12.3 percent for the 2016 first quarter.

Net sales for the Company’s Concentrate segment for the 2016 first quarter were $55.9 million. There were no corresponding sales in the comparable 2015 quarter. As a result of the TCCC Transaction, there were no net sales for the Company’s Other segment in the 2016 first quarter, as compared to $31.3 million for the same period last year.

Gross sales to customers outside the United States increased to $184.4 million in the 2016 first quarter from $141.0 million in the corresponding quarter in 2015. Net sales to customers outside the United States rose to $149.1 million in the 2016 first quarter from $113.0 million in the corresponding quarter in 2015.

Gross profit, as a percentage of net sales, for the 2016 first quarter increased to 62.2 percent from 58.9 percent for the comparable 2015 first quarter. Gross profit for the 2015 first quarter excluding acceleration of deferred revenue was 56.1 percent.

Operating expenses for the 2016 first quarter were $168.4 million, as compared with $361.3 million in the first quarter last year. Excluding distributor termination costs and TCCC Transaction expenses, operating expenses for the 2016 first quarter were $164.9 million, as compared with $151.8 million in the first quarter last year.

Distribution costs as a percentage of net sales were 3.4 percent for the 2016 first quarter, compared with 4.1 percent in the first quarter last year. Excluding acceleration of deferred revenue, distribution costs as a percentage of net sales were 4.4 percent for the comparable 2015 first quarter.

Selling expenses as a percentage of net sales for the 2016 first quarter were 10.2 percent, compared with 10.0 percent in the first quarter last year. Excluding acceleration of deferred revenue, selling expenses as a percentage of net sales were 10.6 percent for the comparable 2015 first quarter.

General and administrative expenses for the 2016 first quarter were $75.8 million, or 11.1 percent of net sales, as compared with $273.1 million, or 43.6 percent of net sales, for the comparable 2015 first quarter. Excluding acceleration of deferred revenue, distributor termination costs and TCCC Transaction expenses, general and administration costs as a percentage of net sales for the 2015 first quarter were 10.8 percent. Stock-based compensation (a non-cash item) was $10.1 million for the first quarter of 2016, compared with $6.4 million in the first quarter last year.

Operating income for the 2016 first quarter increased to $254.7 million from $7.6 million in the comparable 2015 quarter. Excluding acceleration of deferred revenue, distributor termination costs and TCCC Transaction expenses, operating income for the 2016 first quarter increased 45.5 percent to $258.2 million from $177.4 million in the comparable 2015 quarter.

The effective tax rate for the 2016 first quarter was 35.8 percent, compared with 50.2 percent in the same period last year. Excluding acceleration of deferred revenue, distributor termination costs and TCCC Transaction expenses, the effective tax rate for the 2015 first quarter would have been approximately 38.0 percent.

Net income for the 2016 first quarter increased to $163.9 million from $4.4 million in the same period last year. Excluding acceleration of deferred revenue, distributor termination costs and TCCC Transaction expenses, net income for the 2016 first quarter increased 49.9 percent to $166.1 million from $110.8 million in the comparable 2015 quarter. Net income per diluted share increased to $0.79 from $0.03 in the same period last year. Excluding acceleration of deferred revenue, distributor termination costs and TCCC Transaction expenses, net income per diluted share for the 2016 first quarter increased 25.9 percent to $0.80 from $0.64 in the comparable 2015 quarter.

On April 1, 2016, Monster Beverage Corporation completed its previously announced acquisition of American Fruits and Flavors (“AFF”), the Company’s principal flavor supplier.

Rodney C. Sacks, Chairman and Chief Executive Officer, said: “The integration of AFF is proceeding in line with expectations. This transaction secures our ownership of the unique intellectual property of many of our key flavors.

Rodney C. Sacks, Chairman and Chief Executive Officer, said: “The integration of AFF is proceeding in line with expectations. This transaction secures our ownership of the unique intellectual property of many of our key flavors.

“Additionally, we are pleased to note continued progress on the implementation of our strategic alignment with Coca-Cola bottlers internationally. In particular, we have concluded agreements with Coca-Cola Amatil and will be launching our Monster Energy® drinks in Australia and New Zealand in May 2016 with Coca-Cola Amatil. We are also pleased to report that we have reached agreements with a number of other international Coca-Cola bottlers for distribution of our Monster Energy® drinks. In the United States, the Coca-Cola bottlers have expanded the number of outlets in which Monster Energy® drinks are available, and we are seeing improvements in our levels of distribution.

“The continued strength of the U.S. dollar, distributor transitions and uncertainties in portions of our international non-Coca-Cola distribution network also impacted our results,” Sacks added.

Intention to Commence Tender Offer

Consistent with the Company’s previously announced plan to return capital to shareholders in 2016, the Company currently intends to commence a tender offer in May to purchase up to $2.0 billion in value of its common stock through a modified “Dutch auction” tender offer at a price range to be specified.

The Company will fund the tender offer with cash on hand.

The Company’s two founders have indicated that they may participate in the offer, however they will continue to own a substantial majority of their current holdings following any successful tender offer.